child tax credit 2021 dates direct deposit

WASHINGTON The Internal Revenue Service today updated frequently asked questions FAQs for the 2021 Child Tax Credit and Advance Child Tax Credit to help eligible families properly claim the credit when they prepare and file their 2021 tax return. The IRS is distributing half of the credit as an advance on 2021 taxes in six monthly installments worth 250 to 300 per child.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Child tax credit november 2021 direct deposit Saturday May 14 2022 Edit CBS Baltimore -- The fifth Child Tax Credit payment from the Internal Revenue Service IRS will be sent this coming Monday.

. Eligible families will receive a lump. November 25 2022 Havent received your payment. Benefit and credit payment dates reminders.

Wait 5 working days from the payment date to contact us. For each kid between the ages of 6 and 17 up to 1500 will come as 250 monthly payments six times this year. The Child Tax Credit provides money to support American families.

Child Tax Credit Update Portal to Close April 19. You can beneit from the credit even if you. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

For each qualifying child age 5 and younger up to 1800 half the total will come in six 300. The IRS is relying on bank account information provided by people through their tax. For the first time in US.

WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax Credit payments as direct deposits begin posting in bank accounts and checks arrive in mailboxes. Payments begin July 15 and will be sent monthly through December 15 without any further action required. 15 opt out by Nov.

It also made the. This first batch of advance monthly payments worth roughly 15 billion. To reconcile advance payments on your 2021 return.

The American Rescue Plan significantly increased the amount of Child Tax Credit a family could receive for 2021 typically from 2000 to 3000 or 3600 per qualifying child. This portal closes Tuesday April 19 at 1201 am. A Since July of this year more than 35 million American families have benefited from these monthly payments due to the recently enhanced child tax credit CTC.

When Will the Advance 2021 Child Tax Credit Payments Start. Enter your information on Schedule 8812 Form. Monthly payments will begin on July 15 2021 and will be sent out through direct deposit paper check or.

Payments were posted on the 15th of every month from July to December or earlier when the 15th fell on a holiday or a weekend. You need that information for your 2021 tax return. The payments will be made either by direct deposit or by paper check depending on what information the IRS has on file for each recipient.

Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month. 29 What happens with the child tax credit payments after December. Wait 10 working days from the payment date to contact us.

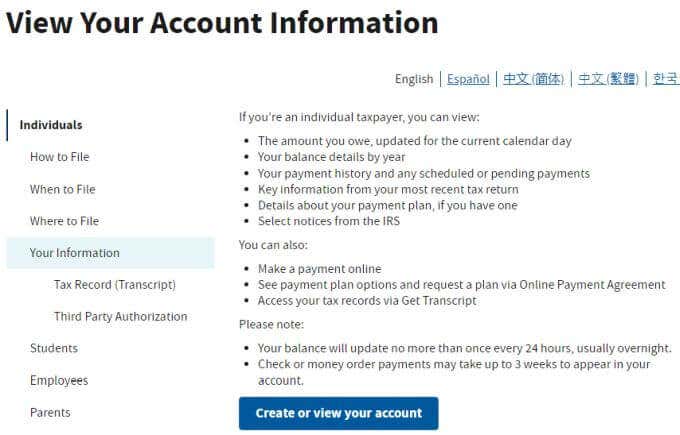

Alberta child and family benefit ACFB All payment dates. Get your advance payments total and number of qualifying children in your online account. 13 opt out by Aug.

For tax year 2021 the Child Tax Credit increased from 2000 per qualifying child to. Here is some important information to understand about this years Child Tax Credit. 15 opt out by Aug.

31 2021 so a 5-year-old child turning 6 in 2021 will qualify for a maximum of 250 per month. IR-2022-10 January 11 2022. For both age groups the rest of the payment will come with your 2021 tax.

Find the total Child Tax Credit payments you received in your online account or in the Letter 6419 we mailed you. Nearly 90 percent of advanced Child Tax Credit payments were paid through direct deposit. The remaining 1800 will be.

Related services and information. The current tax season has been as bumpy as the last with many tax filers reporting delayed refund payments due to IRS processing backlogs and reconciliation of catch-up payments for stimulus checks RRC and advance child tax credit payments. 15 opt out by Nov.

WASHINGTON The Internal Revenue Service today updated its frequently asked questions FAQs FS-2022-17 PDF on the 2021 Child Tax Credit and Advance Child Tax Credit PaymentsThese updates are to help eligible families properly claim the credit when they prepare and file their 2021 tax return. The fourth payment date is Friday October 15 with the IRS sending most of the checks via direct deposit. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

2021 Advance Child Tax Credit Payments start July 15 2021 Eligible families can receive advance payments of up to 300 per month for each child under age 6 and up to 250 per month for each child age 6 and above. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. The estimated 2021-2022 IRS refund processing schedule below has been updated to reflect the official start.

The 500 nonrefundable Credit for Other Dependents amount has not changed. IR-2022-53 March 8 2022. 3600 for children ages 5 and under at the end of 2021.

This is a 2021 Child Tax Credit payment that may have been received monthly between July and December. 15 1800 for each child under 6 and up to 1500 for each child 6. The IRS bases your childs eligibility on their age on Dec.

Because the CTC is a tax credit for the 2021 tax year children born in the current calendar year qualify for the payments. This extensive FAQ update PDF includes multiple streamlined questions for use by. IR-2021-153 July 15 2021.

Each of the six installments is around 15 billion adding up to roughly 90 billion in tax credits by. By August 2 for the August. 15 opt out by Oct.

History a major tax credit is being distributed in monthly advance payments. The way the child tax credit payments will be divided between 2021 and 2022 might be confusing. 3000 for children ages 6 through 17 at the end of 2021.

Missing A Child Tax Credit Payment Here S How To Track It Cnet

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Deposits Of 1 200 Stimulus Checks Will Start Arriving Wednesday Tax Refund Payroll Checks Money Template

How To Set Up Direct Deposit With Irs

Irs Still Being Processed Vs Being Processed Refundtalk Com Irs Process Messages

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Paypal Payroll Direct Deposit Paypal Us

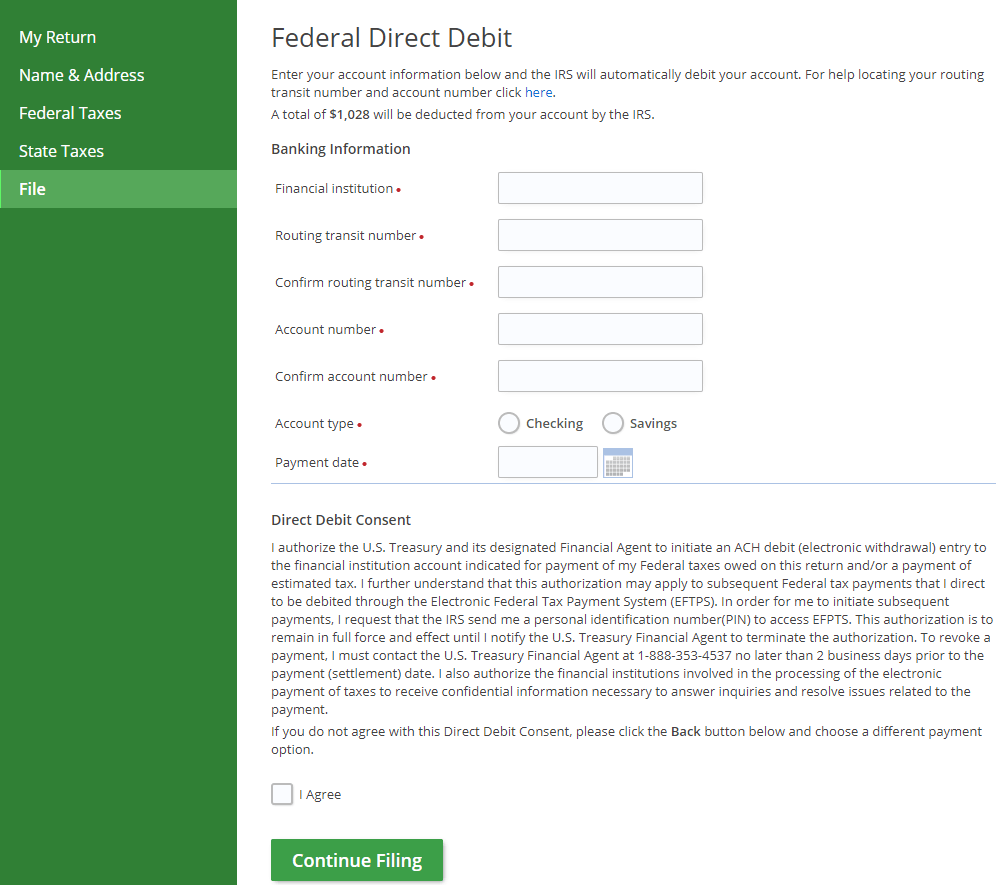

Pay Your Federal Taxes Or State Taxes Due On Efile Com Debit Check

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

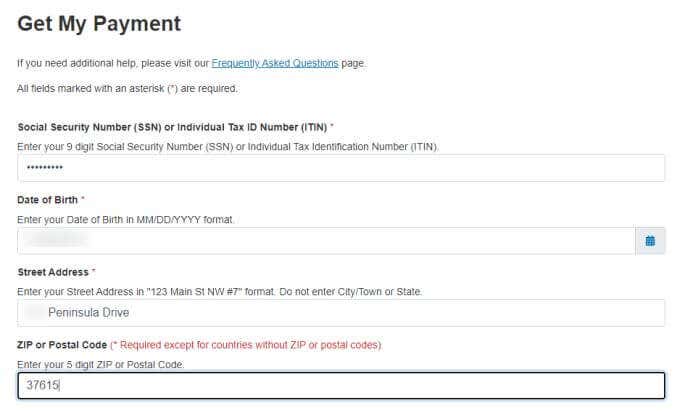

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Get Your Irs Refund Cycle Chart 2022 Here Diy Taxes Tax Refund Refund

Direct Deposit Your Tax Refund Fidelity

Childctc The Child Tax Credit The White House

Metabank Statement Regarding Economic Impact Payments And Tax Solutions Metabank